Our Solutions

Our Solutions

ACCOUNTS RECEIVABLE FINANCING

Accounts receivable financing is designed to alleviate the challenges posed by delayed customer payments. Instead of waiting for your customers to settle their invoices, this financing option empowers you to access a portion of the invoice value upfront, helping you bridge the gap between service delivery and payment collection.

Why AR Financing?

Accounts receivable financing offers businesses a range of benefits, including improved cash flow, reduced reliance on customer payment timing, and the ability to focus on core operations rather than chasing late payments. It’s a versatile solution suitable for businesses of various sizes and industries, from startups to established enterprises.

How does it work?

Accounts Receivable financing allows you to convert your unpaid customer invoices into immediate working capital, providing the financial flexibility to fuel your growth and meet your business obligations.

Here’s a glimpse into how Accounts Receivables Financing typically operates:

- Application for AR Financing: The financing provider assesses your eligibility based on factors such as the quality of your outstanding invoices and the creditworthiness of your customers.

- Invoice Verification: The financing company reviews the invoices you wish to finance. They evaluate factors such as the creditworthiness of your customers and the authenticity of the invoices.

- Funding Offer: If approved, the financing company offers you a cash advance based on a percentage of the total value of the invoices. This percentage can range from 70% to 90%, depending on various factors. Once you accept the financing offer, the financing company provides you with an immediate cash advance. This gives you access to a significant portion of the invoice value upfront.

- Receiving the Remaining Amount: After your customers pay the invoices, the financing company releases the remaining amount of the invoice value to you, minus any fees or charges.

- Repayment: The financing company collects the full invoice amount from your customers. They deduct their fee from the total invoice value. As you continue to generate new invoices, you can repeatedly use AR financing to maintain a steady cash flow. This makes it easier to manage operational costs, invest in growth, and seize new opportunities.

Request a Consult

AR FINANCING

FAQ

Invoices for goods or services provided to commercial customers can generally be financed. B2B (business-to-business) transactions are often the focus of AR financing.

The upfront advance can range from 70% to 90% of the total invoice value, depending on factors such as the financing company’s policies and the creditworthiness of the customers.

Depending on the agreement, the business may be responsible for repurchasing the unpaid invoices from the financing company. This is known as recourse factoring. Non-recourse factoring shifts the risk of non-payment to the financing company.

Having outstanding loans may impact your eligibility for AR financing. It’s important to discuss your existing financial obligations with the financing provider.

AR financing doesn’t typically involve long-term commitments. It offers flexibility, allowing businesses to use it as needed.

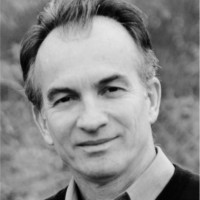

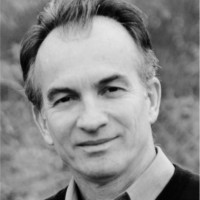

Why Amrock Financial?

AmRock Financial hasprovided $1 billion + in financing to more than

400+ small and mid-sized businesses in the US and Canada over the last 16 years, working with a pre-

approved network of 1700+banks and Non-bank lenders nationwide.

If you are looking for a business loan, refinancing or additional working

capital, we provide Debt Structures from $1 million to $100 million.

Although banks have reduced lending in today’s market there are many other funding options available to you.

If you’re interested in scheduling a 30 min introductory call, book a meeting here:

Overview of our

Financial Solutions

If you’re in need of financing for your business, asset-based lending provides a unique and flexible solution leveraging your company’s tangible assets.

If you’re a small business owner seeking financing, the U.S. Small Business Administration (SBA) offers a range of loan programs to access affordable capital with favorable terms and flexible repayment options.

Factoring can be a valuable financing solution to improve cash flow. Convert your accounts receivable into immediate cash to optimize your cash flow.

Whether you’re an aviation enthusiast or a business professional seeking to acquire an aircraft, we’re here to guide you through the process.

A specialized financing option designed to help businesses cover the costs of fulfilling customer orders without depleting their working capital.

Trade financing can provide you with the necessary working capital solutions, and risk management tools to navigate the complexities of the global marketplace.

- 1001 Brickell Bay Drive 27th Floor Miami, Florida 33131

- 305-440-8480

- applications@amrockfinancial.com