The best bank for you might be in Massachusetts, Michigan, or Texas!

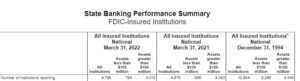

Since 1994, approximately 7,808 banks have left the industry because of mergers, consolidations, or failures, FDIC data show. An unpredictable economy and more regulations have taken their toll on the sector, leaving small business owners with fewer options to find the right lender.

Despite a historically low number of bank failures in recent years, the slow and steady decline in bank numbers continues. Few new banks are being chartered, and banks continue to merge with one another, reducing the number of charters.

Because changes in banking policy are often widespread, they can have systemic effects on the economy. As banks tightened their credit policies and began offering fewer loans and lines of credit to small companies, during a recession, banking effects on business may be magnified because cash is in such high demand.

Tips for Finding Financial Help

1. Research who is the right bank for your industry. It is not always the one nearest.

2. Consider a loan advisor. Just as many consumers would like to have a physical bank nearby, a good advisor is often preferred by many consumers. A good loan advisor can help you make smarter financial decisions to be in better control of your money while also being available for day-to-day questions you may have.

3. Look for other business owners and make time to ask specific questions directly related to their experience and your challenges.

4. Invest early in getting your financial statements up to date, corporate structure, ownership structure, and shareholders agreements in place.

5. Consider insuring your accounts receivables before contacting a new lender.

At AmRock Financial, our experts specialize in helping business owners & entrepreneurs obtain the capital they need to succeed. By having the right financing in place, businesses can avoid cash-flow challenges, take advantage of their growth potential & increase profitability. We provide direct funding to clients through purchase order finance, inventory & structured trade financing. If we are unable to finance your business directly, we will leverage our long-established relationships with more than 1,500 lenders to secure the financing you need to survive & thrive.

You pay nothing if we are unable to get you funded. We only charge a success fee after you get funded, so our services are FREE until we succeed.